Can Decred Become Digital Cash?

My store of value in the digital cash world, without a shadow of doubt, is Decred as it builds on the principles of the original Bitcoin…

My store of value in the digital cash world, without a shadow of doubt, is Decred as it builds on the principles of the original Bitcoin and then identifies and aims to improve the known issues.

But the question for this article is, can Decred take it to the next level and become peer to peer cash in the truest form?

Let’s start by formalising the term “peer to peer cash” as perceived in this article:

I have some money in my pocket and I give it to a vendor for a service provided. Sometimes the service will be small and the amount will be pennies and some time the service will be big and require hundreds of pounds. But at no point does anyone else get involved in the transaction.

To truly be peer to peer, at no point should there be fees from an outside party. The transaction is between me and the vendor just like a cash transaction in the real world.

The first argument to this problem:

How did you get the money in the first place or don’t forget the vendor will still have to pay tax on the transaction?

That’s fine but even in the digital world these items have to be applied. The problem I have is, there is now another entity sitting in the middle of each transaction taking a fee for your participation. Whether that be PayPal or a POW miner or a Delegated POS provider, doesn’t matter, they are all looking for their piece of the pie. Effectively, applying a secondary tax whenever you want to spend your money.

The second argument to this problem:

If you have no fees how are you going to keep the system secure. Do you expect people to work for free? Would you work for free? Without Incentives the system won’t work, it can’t work!.

I understand this argument, but incentives don’t always have to be financial and just because a system aims to be fee-less doesn’t mean it’s free. There is always an inherent cost and normally this is energy. Miners get paid because of the energy they use; stakeholders get paid because of the risk they take in securing the network; There was even energy applied to my real-world peer to peer transaction. If the energy could be applied at source the burden could be spread to every participant in the network alleviating the need for central middlemen and reducing waste.

If you use the system, and you have a portion of your wealth invested in it, it’s in your best interest to help secure it. Another fact that is lost on many people are the majority of us already have the tech in our pocket to participate in this action if the system facilitated it.

Side-note: Most people in this space now acknowledge that POW mining has a centralising effect especially where ASIC miners are needed. Although, ASIC POW is currently our best option doesn’t mean it’s our only option.

Rewards are penalties

One of my biggest concerns with a fee-based system is, on one side there is an incentive but on the other side there is a tax. If you’re early, and you have the resources you will become exponentially more wealthy profiting from block rewards, transaction fees and asset price rises long into the future. On the flip side, if you have limited resources, and you are late you will have a considerably lower supply of the coins, no block reward, higher transaction fees, and missed out on the exponential price appreciation. Your potential for growth in the project will be vastly more limited, to that of the early adopter. Meaning it’s likely that the late adopter will seek an alternative that meets their requirements and seems fairer to their current circumstances. This effect is currently being witnessed in the BTC world where fees can be anything from +£10 and the price per coin is +£25,000 and where the average user has no potential to participate in the security of the system.

If a crypto project is going to have the potential to last for the long-haul it needs to solve problems and the peer to peer cash problem still exists. Whether we accept this or not peer to peer cash was the original goal of Bitcoin, this was and still is the catalyst for the majority of cryptocurrency projects. But to date, very few are actively developing in this area or brush it under the carpet because the problem is too difficult to solve.

Can cryptocurrencies, at scale, be used for small transactions with zero fees?

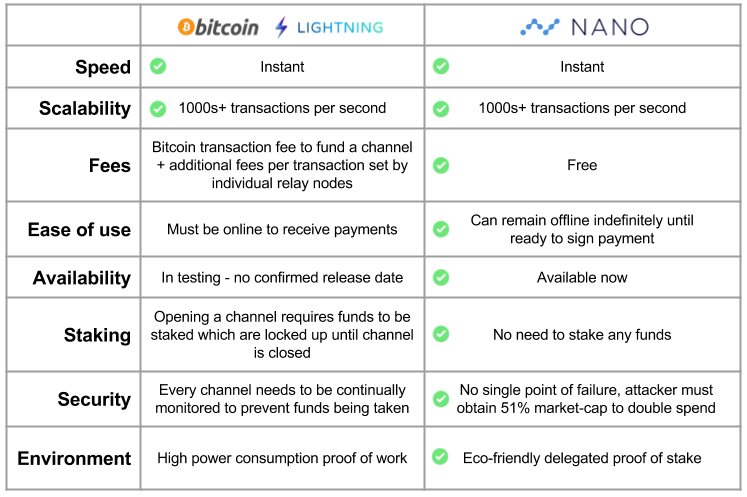

Whenever you try to have the peer to peer cash discussion you will more than likely be pointed to the Lightning Network as the ultimate solution where nothing else comes close. Lightning is definitely one option but it to is not without its trade-offs, security being one of them and although the fees are super low it’s still not fee-less. There is still a trusted third party sat in the middle of the transaction.

One of the biggest concerns with Lightning from a business owner’s perspective is the transactions are not published to the chain. This may not seem like a big problem to an individual buying a cup of coffee. But if you are the coffee shop own this is a massive turn off because you miss out on the security the blockchain provided in the first place.

Don’t get me wrong the Lightning Network technology is amazing and has a lot of potential for the future, but I still feel there’s got to be a better or different solution that solves this problem absolutely. I still feel that if blockchain is going to succeed this has to be achieved on the first layer, the currency layer.

Can fee-less transactions take place on the base layer of a blockchain?

It’s my personal belief that there is still a lot more value to be gained by developing solutions on the base layer of a blockchain. In a short time from now central banks will come along with their digital currencies and says, “How can Bitcoin be better, we have no fees on transactions!?”

Cryptocurrencies have to be better in every way, no argument will convince a poor person to pay £15 in fees for each transaction. I would also argue, over time, that most would resent even paying a fraction of a penny if there was a fee-less alternative.

Should a single blockchain try to do everything?

As we all know Decred is upgradable and adaptable which gives the project a long-term future but at this point I would argue, Decred doesn’t have to do everything. The reason for this is because of the trade-offs. If you add new functionality you inherently reduce security; make the chain bigger and add a magnitude of complexity.

To date the Decred team has been careful with the development of the project, giving careful thought to each solution implemented. Because of the careful decisions made, Decred has a relatively small blockchain (approximately 6GB after 5 years of being active); it’s hyper secure and has top-level features that most projects can only dream about.

But can I use it to buy my daily coffee?

Currently, you can use it to buy your daily coffee with only a fraction of a penny to be paid in fees but the transaction time, for at least four confirmations, could still be plus ten minutes and at scale the problem becomes similar to BTC. So to be honest Decred at scale will struggle to be cash, that can be used for my daily coffee, but remember this is likely to be the same with all POW chains.

At scale a POW chains can still only produce a curtain number of transactions based on the block size. Once, blocks start to get filled the chain starts to get slower and more expensive to transact with. There are a few ways around this issue but all have their trade-offs:

Bigger blocks = Bigger blockchain and the heightened possibility of more centralisation.

Faster block times = Bigger blockchain and the heightened possibility of more centralisation.

The Lightning Network (as said above) could solve this problem but actually Decred has another way that could be even better if it thinks of its self as a facilitator for the greater cryptocurrency space.

Enter the power of a fee-less Decentralised Exchange

Most crypto project think of themselves as an island, and they will eventually be the only remaining project in the space. This is unlikely, but even worst, by thinking this way they are missing out on the amazing work that is happening in other project in this space. What if you could utilise all of this great work without the massive trade-offs; without needing to exhaust your funds or divert development time to an effort that already exist.

Interoperability with other crypto project through the fee-less Decred DCRDEX could give Decred a unique position in the space. There are many projects that are working on interoperability but most add an extra layer of complexity, or surprises surprise more fees. With DCRDEX this is eliminated, no fees, no added complexity, no compromises on security and no additional unnecessary weight to the size of the blockchain.

My next thought is how could this be used as part of the peer to peer digital cash problem, if Decred isn’t solving it directly? Imagine storing your wealth in Decred because of all the benefits the project gives you like governance, privacy, security and not forgetting staking to earn regular rewards. Then withdrawing a small amount each month to another project to pay your bills and use for real life payments. I envision withdrawing a monthly amount e.g. higher than 1 dcr to lump all of my expenses in one transaction which in turn will reduce the overall fees. This doesn’t completely solve the peer to peer cash problem as there are still fees, but you will start to get the best of both worlds. A world where security and store of value matter along with a world where using your coins as cash matters.

Which cryptocurrency project is best to use for daily transactions?

Let’s keep in mind the preposition here is the assumption that a store of value coin works differently to a peer to peer cash coin. Now let me be clear, it’s a project that is unlikely to be as secure as Decred or be a SOV, but it must be secure enough to hold small amounts of money and do regular transactions.

SOV — needs to be hyper secure which normally results in slower transactions with higher fees

PTPC — needs to be fast, where the majority of transactions complete in under 10 seconds with no fees applied to the transaction at either end (Sending or receiving)

Where has my search for digital Peer to Peer cash got me so far?

Over the past few months, I have been doing a lot of research in this area and frankly pickings are slim. Once you evaluate a project at scale of needing +300 transactions per second. It tends to either bottleneck or become more centralised or surprise surprise fees start to enter into the equation.

Projects that I’ve already researched and rejected for this use case include — Bitcoin, Ethereum, digibyte, Bitcoin Cash, Dash, Iota, byteball, EOS, XRP, Stellar, Tether, Waves and the list goes on …

But there is one that might fit the requirements of fast, fee-less, decentralised peer to peer cash that could compliment Decred. That’s a little known project called Nano. Now I’m still researching so this is by no means conclusive, but my initial findings are really positive. The majority of my transactions on the Nano network confirmed and completed in under one second with no fees, even sending 1 raw which is their smallest unit. On the various tests that the network has performed 300+ transaction per second seems easily achievable with each user only needing to perform the smallest about of POW to get their transaction to complete in under one second.

The user experience to this point has been very enjoyable and being a small business own it was also good to see that merchant tools had already started to be built and implemented including various point of sale devices and mobile apps.

Try Nano for yourself

Firstly, download the “Natrium” wallet and backup / write down your seed to secure your Nano. Now head on over to the free Nano faucet to receive a small amount of Nano. This is a great test to see how fast the transactions complete with such a small amount, all fee-less: https://nano-faucet.org

Other great links and resources to look at:

https://nano.org — The official website for the project

https://wenano.net — Some fun experiences to receive and donate Nano

https://somenano.com — Some interesting Nano experiences and visualisations

https://nanotipbot.com — Send and receive nano tips through twitter engagement

https://nanopaperwallet.com — Create Nano gift cards or store small amounts of Nano as an offline wallet.

Final thought

To sum up, it never stops to amaze me how much innovation and creativity happens in this space. The projects that stand out are those that are trying to keep it simple and solve real problems. To this point blockchains prominent use case is money, so it makes sense to aim to get the best kind of money. Frankly, usable, fee-less, limited supply, peer to peer digital cash is probably as good as it gets.

Digital peer to peer cash should be better than what has come before in every way. We should aim to remove the middle men not replace them!

If you like this article and the unbiased opinions of the autor, make a small donation to show your appreciation.

DCR Donation Address: DsahjKtXPeMFqN5AXr3Vim5TMDYAGdhPKqj

Nano Donation Address: nano_3w88wdcg8sifd83dwco54ssenaq6qeqn1fhx3bwe5ua59kdmz7qnobnob6cx

Disclaimer — Please note the above research is not financial advice and you should always do your own due diligence before investing your money. Investments can go down as well as up and cryptocurrencies are typically volatile assets.

The views expressed in this article are that of the author and based on the authors own research and investigation. The author is happy to receive comments, feedback and suggested edits for this channel to help evolve the open nature of the discussion.