Obligatory: this is not financial advice and I am not a financial advisor.

Stonk Uncertainty

Stonks continued their dump this week but they could make a higher low depending on how the next week plays out.

Bitcoin IS an altcoin (relatively speaking)

As much as people don’t like it, Bitcoin is in reality just another altcoin when it comes to larger markets. I’ve outlined the Correlation Coefficient indicator at the bottom of this chart and tied it to the S&P futures. You can see it’s still being manhandled by tradFi markets in time of uncertainty. Does this mean it’s failed it’s original purpose as wallstreet enters? That question is for another time.

Decred is to Bitcoin as Bitcoin is to tradFi

Since everything is daisy chained together in terms of pecking order Decred doesn’t have permission yet for any sustained moves. We bounced off of the 1 day cloud and are now leashed back to Bitcoin which is leashed back to stonks.

VWAP

I recently read a short article on VWAP. Seems like black magic but maybe there’s some alpha to it so I’m playing around with it.

Here’s an anchored VWAP from the day of the first massive pump. From there it’s managed to call consistent support and resistance although you could’ve also extrapolated that yourself if you had assumed it was just going to keep ranging between $50-70. The blue line is the VWAP and the bands around it are standard deviations that can be configured. I’ve changed the multiplier on them from 1 → 2.

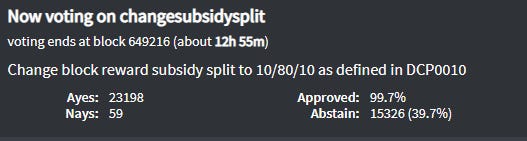

As I said before, I’m still a very interested buyer at $50 and below, it’s just too good of a deal with 10/80 just 13 hours away.

Real bisons hodl.